What is Step-Up SIP?

A Step-Up SIP, also known as Top Up SIP, is a type of SIP (Systematic Investment Plan) where you can increase your investment amount periodically by either a fixed percentage or a fixed amount every year. Unlike a regular SIP, where the monthly investment remains constant, a Step-Up SIP lets you systematically increase your investment amount at pre-determined intervals. Step Up Sip helps you adapt to changing financial situations and goals. Step-up SIP benefits young professionals or individuals anticipating regular salary increments.

How does Step-Up SIP Work?

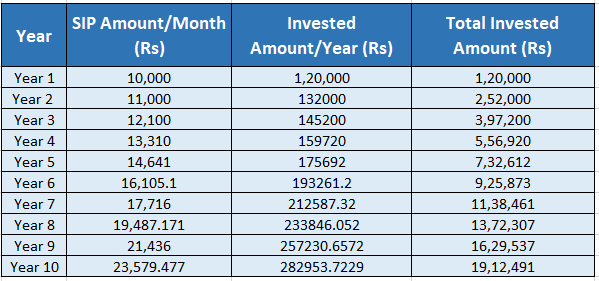

Let’s understand how Step Up SIP works with an example. Suppose you want to do a SIP of Rs.10,000 with a step up of 10% every year then the investment will look like below:

Step Up SIP invested amount summary

Below table is for Illustration purposes only.

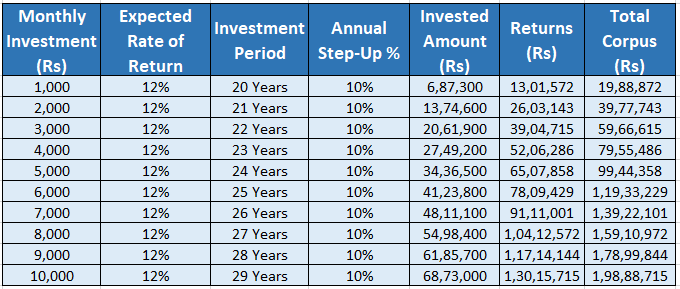

Step-Up SIP Returns at a glance

Steps involved in working on Step-Up SIP

- Initial Investment: You set up the Step-Up SIP based on your financial capability and investment goals. The time horizon and the frequency is determined at this stage.

- Gradual Increments: You increase a certain percentage of SIP on predetermined intervals. The flexibility offered by Step-Up SIP to increase the contribution amount periodically is a great feature.

- Power of Compounding: As the SIP amount keeps on increasing every year or the period decided by you the potential for higher returns through compounding also increases. Returns get reinvested again and again, leading to accelerated growth of the investment over time.

- Long-term wealth creation: Investors can systematically build wealth and work towards achieving long-term financial objectives by utilizing Step Up SIP. It is a very disciplined approach to investing while keeping in mind the changing financial capacities.

Why should invest via Step-Up SIP?

The Step-up SIP is more suitable for the below type of individuals

- Young professionals who have just started earning income and expect their income to increase over time.

- Investors with long-term financial goals, such as retirement planning, buying a house, or funding their children’s education.

- Young parents who want to plan their child’s future expenses well in advance.

- Investors with long-term horizons and whose financial priorities evolve.

- Individuals who want a structured investment strategy and seek flexibility to adjust their contributions based on market conditions and their financial capabilities.

When to start and stop Step-Up SIP?

When to start Step-Up SIP?

- Start early in your career: Starting Step Up SIP early makes you take advantage of the power of compounding as the longer your money remains invested, the more is the potential for wealth creation.

- When you have clear financial goals for yourself: When you set clear financial goals for yourself like buying a house, funding education, or retirement planning, Step-Up SIPs are a great option.

- When you have a stable income: Having a stable and regular source of income ensures that you can commit to regular contributions of money without any disruptions.

- When market conditions are favorable: Starting a Step-Up SIP during market corrections or when valuations seem low can be beneficial because this allows you to purchase more mutual fund units at lower prices.

When to stop a Step-Up SIP?

- During your tough financial condition: When you face financial emergencies or unforeseen hardships, you can think to pause or stop your Step-Up SIP temporarily to manage immediate expenses.

- When your investment objectives change: When you set new financial objectives for yourself and the current Step-Up investment strategy no longer in sync with your new objectives, it might be a wise decision to stop or pause the Step-Up SIP.

- When you see better investment opportunities around When you see attractive investment opportunities that better suit your financial goals, you can think of redirecting your funds from the Step-Up SIP to the new investment.

- When your financial goals are met: When your financial goals are met such as reaching a target corpus or fulfilling specific life goals, you may consider stopping the Step-Up SIP.

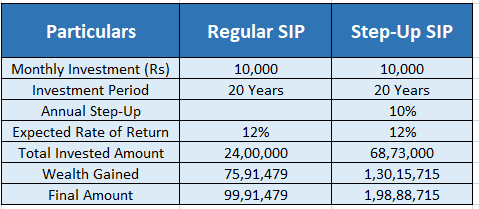

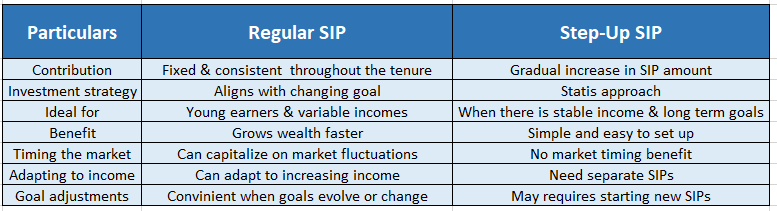

Regular SIP vs Step-Up SIP

The major differences between regular SIP and Step-Up SIP are as under.

Sample illustration of SIP returns vs Step-Up SIP returns