Systematic Withdrawal Plan (SWP) – What is it & How it Works?

A systematic withdrawal plan or SWP is a plan in which you withdraw money from your mutual fund in a regular and planned manner. First, you must decide how much money you need and at what frequency, often monthly. Once you set up an SWP, the mutual fund house will redeem the required units from your mutual fund holdings and credit the amount in your bank account. In short, this is a process opposite of SIPs.

For people such as retirees, who want a regular income from their investments SWP is a great option. In SWP you only sell a small portion of your mutual fund units regularly and your remaining corpus keeps growing.

How does SWP Work?

SWP is quite easy to set up nowadays. Firstly, you have to choose a good mutual fund scheme and invest via SIP or lumpsum. Now you have to set up an SWP, wherein you instruct the mutual fund house to withdraw a fixed amount from your mutual fund at regular intervals (usually monthly, quarterly, or annually) and transfer it to your bank account.

When the withdrawal date arrives, the mutual fund house will sell your mutual funds in proportion to your required withdrawal amount and credit to your bank account. This process of withdrawing your mutual units will continue for a period decided by you or until you cancel your SWP. Your remaining amount in your fund will continue to earn returns based on the performance of the mutual fund.

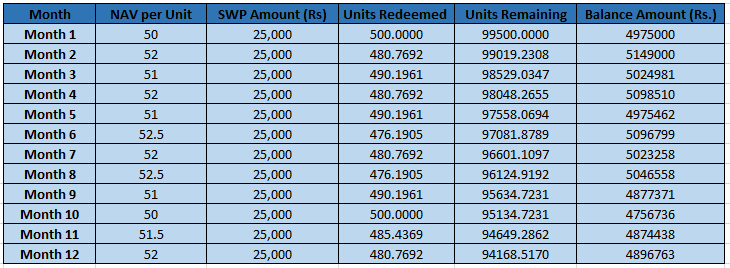

Let us discuss an example to understand more about how exactly SWP works. Suppose you have a total investment of Rs.50 Lakhs in a mutual fund, divided into 1,00,000 units of Rs. 50 each. You decide to redeem Rs. 25,000 every month. Here is how your SWP will work out in the next 6 months.

In the above example, we can make out that the number of units reduces over time but if the mutual fund NAV appreciates at a percentage higher than the withdrawal rate, the invested amount appreciates. However, if the NAV falls instead of rising, the effect will be opposite.

Advantages of Systematic Withdrawal Plan

- Gives a Regular and Predictable Income: A Systematic Withdrawal Plan allows you to withdraw a fixed amount of money at regular intervals, thus providing a reliable stream of income to support your expenses and making you plan your budget effectively.

- Capital Appreciation: You can see in the above example that if the SWP withdrawal rate is lower than the mutual fund return rate, you will get some capital appreciation in the long term.

- You need not Time the Market: In case of lumpsum withdrawal from the mutual funds you must possess sound market knowledge to know when to withdraw. Timing the market is quite challenging and tricky, but in the case of SWP, you avoid all this hassle. A fixed withdrawal amount every month helps you maintain investment discipline, avoiding impulsive large withdrawals and preserving the investment corpus.

- Advantage of Rupee Cost of Averaging: By redeeming a fixed amount at regular intervals, you are likely to sell units at various price points, both high and low. Thus, you average out sale prices, potentially leading to a higher average sale price per unit during favorable market conditions. As a result, net return increases, providing a more stable and higher income stream.

- Tailored Withdrawals: Systematic Withdrawal Plan allows you to customize your withdrawal amounts and intervals, providing flexibility in managing income streams.

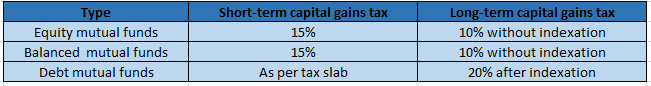

- Tax Benefits: With an SWP, tax is not deducted at the source. However, capital gains tax is applicable based on the mutual fund scheme type and withdrawal amount. In the below table, you can see capital gains tax for various mutual fund types.

Who should opt for SWP?

- For those who are looking for a regular secondary income source: Having an extra income source is important to overcome the rising cost of living. SWP is an excellent method to generate a steady secondary income. In today’s world, just a single source of income may not be enough, thus SWP can be handy in such cases.

- For those who want to create their pension: In the case of people who will retire in the coming years and have not invested in any retirement savings scheme, SWP can be one of the best options. Under SWP, you can set how much amount you want to receive after retirement, and when you retire, you can have a regular income as a pension from SWP.

- For those who want to protect their capital: Instead of redeeming your entire investment of mutual funds in one go, in SWP you can withdraw smaller amounts systematically. This way, a big portion of your portfolio remains invested for the long term and continues to grow.

- For those in a high tax bracket: Investors who fall in a high-income tax bracket, SWP is quite advantageous because there is no Tax Deducted at Source (TDS) on capital gains. Capital gains from equity or equity-oriented mutual funds are taxed at a moderate rate. Gains from debt-oriented mutual funds also benefit because of moderate taxation due to the allowance of indexation on long-term capital gains.

Situations where SWP may not be suitable

- When you have a short-term investment horizon: SWP may not be ideal for investors who have a short-term investment horizon in mind. Frequent withdrawals can outweigh the benefits of SWP, hindering the ability to capitalize on the market’s long-term potential.

- Investors with limited fund value: For investors who have a limited investment amount or a small mutual fund corpus, an SWP might deplete the fund rapidly, leaving a small room for capital growth.

- People with rising investment scenario: When you have anticipated significant expenses, such as a child’s overseas education, depending solely on SWP with its fixed withdrawal nature might prove insufficient.

Conclusion

A SWP can be a very good tool for generating income from your savings, especially if you are retired or not working anymore hence rely on your savings to support your expenses. You must speak to your financial advisor to assess the suitability of SWP in your case.

Frequently Asked Questions (FAQs)

What is SWP in mutual funds?

SWP in mutual funds is a plan in which you withdraw money from your mutual fund in a regular and planned manner. First, you must decide how much money you need and at what frequency, often monthly. Once you set up an SWP, the mutual fund house will redeem the required number of units from your mutual fund holdings and credit the amount in your bank account. In short, this is a process opposite of SIPs.

What is the disadvantage of SWP?

The disadvantage of SWP includes the risk of the market, as returns are not guaranteed and depend on the chosen fund’s performance. There’s also a potential for capital depletion if your withdrawals every month exceed returns.

How much should you withdraw via SWP?

Retirees can opt for the 4% withdrawal thumb rule, the general rule of thumb suggests that withdrawals should be capped at 4% per annum of the accumulated retirement corpus to ensure a peaceful retirement.

What is the 4% rule of SWP?

The 4% SWP rule says you should withdraw 4% of your mutual fund corpus in the 1st year of redemption. Then, each year, you need to withdraw the same sum after adjusting it for inflation.

Is SWP better than FD?

Choosing between SWP or FD depends on investors’ objectives and risk tolerance. When you want to earn a fixed return on your money without taking the risk of market fluctuations, then FD is a good option. Since income from FDs is fixed, they should be a primary source, and SWPs can be considered next.

What are SWP Interest rates?

SWP is a method of systematic withdrawal from your mutual fund investments and does not have a fixed interest rate. The growth of your corpus depends on the performance of the selected mutual fund.

Is SWP tax-free?

No, SWP in mutual funds is not tax-free. The taxes will depend upon the type of fund and the period of holding.