SIP vs SSY, which one is a better investment?, it is a common confusion amongst the parents who want to invest for their daughter’s future. With various investment options available, choosing the right one can be confusing. Systematic Investment Plans (SIPs) and Sukanya Samriddhi Yojana (SSY) are the two popular investment options for your daughter in India . SIPs are a method of investing in mutual funds, while SSY is a government-backed savings scheme aimed at securing the future of a girl child. This blog post thoroughly explores these two investment options, comparing their benefits, differences, and suitability for investors.

What is SIP?

A systematic investment plan (SIP) is an investment strategy in which you invest a fixed amount of money at regular intervals in a mutual fund. The investment can be weekly, monthly, or quarterly, depending on the investor’s preference. SIPs offer a disciplined approach to investing, helping investors benefit from the power of compounding and rupee cost averaging.

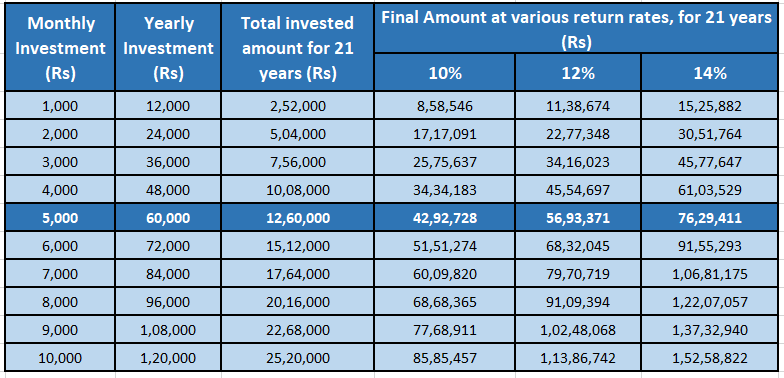

SIP Calculations at a glance

Benefits of SIP

Disciplined Investment: SIPs encourage a disciplined approach to investing. By committing to regular investments, investors can avoid the pitfalls of market timing and emotional decision-making.

Power of Compounding: SIPs benefit from compounding, where the returns earned are reinvested to generate additional returns. Over time, this can lead to substantial wealth creation.

Rupee Cost Averaging: With SIPs, investors buy more units when prices are low and fewer units when prices are high. This averaging effect reduces the overall cost per unit, potentially increasing returns in the long run.

Flexibility: SIPs are highly flexible. Investors can start with small amounts, increase or decrease their contributions, and even stop the SIP.

Diversification: By investing in a mutual fund through SIP, investors can diversify their portfolios across various asset classes, and thus reduce risk.

What is SSY (Sukanya Samriddhi Yojana)?

SSY (Sukanya Samriddhi Yojana) is a small deposit scheme launched by the Government of India in 2015 for the benefit of girl children. Currently, SSY offers an annual interest rate of 8.2%. The account can be opened anytime from the birth of the girl’s child until she turns 10 years old. It can be opened at any post office or branch of a commercial bank. The minimum initial deposit required is ₹250, and the maximum deposit allowed is ₹1.5 lakh per financial year. The funds from the matured SSY account can be used for the girl child’s higher education or marriage expenses.

The SSY account remains active for 21 years from the date of opening or until the girl’s marriage after she turns 18. Partial withdrawals of up to 50% of the balance are allowed for higher education once she turns 18 or passes the 10th grade. The scheme matures in 21 years, but deposits can be made only for the first 15 years. The remaining six years are a lock-in period, during which no deposits are allowed, but the account will continue to earn annual interest on the existing balance.

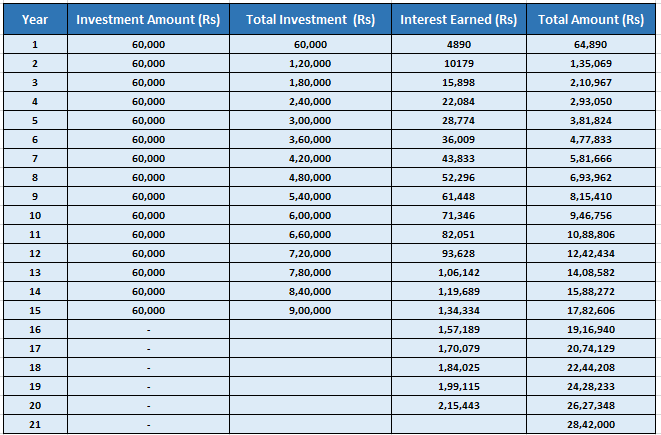

SSY Calculations at a glance:

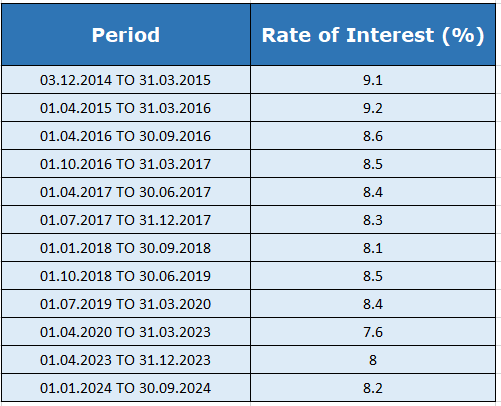

Sukanya Samriddhi Yojana (SSY) Interest Rates Since Inception

Benefits of SSY

Guaranteed Returns: SSY offers a fixed interest rate, which the government revises periodically. As of the current financial year, the interest rate is 8.2%, which is significantly higher than most other fixed-income investment options.

Tax Benefits: Investments in SSY qualify for tax deductions under Section 80C of the Income Tax Act. Additionally, the interest earned and the maturity amount are both tax-free, making it a highly tax-efficient investment.

Long-term Savings: SSY encourages long-term savings with a tenure of 21 years or until the girl marries after turning 18. This makes it an ideal investment for securing a girl’s future.

Low Risk: Since SSY is a government-backed scheme, it carries minimal risk, making it a safe investment choice for conservative investors.

Financial Security for the Girl Child: SSY is exclusively for girl children, ensuring that the saved money is utilized for their benefit, whether for education, marriage, or other financial needs.

Who Should Invest via SIP?

Investors Seeking High Returns: If you are looking for potentially high returns and are willing to take on some risk, SIPs are a good choice. Equity SIPs, in particular, can provide substantial returns over the long term.

Young Professionals: SIPs are ideal for young professionals who have a steady income and a long investment horizon. The power of compounding works best when you start early.

Diversification Seekers: If you want to diversify your portfolio across various asset classes like equity, debt, and hybrid funds, SIPs offer a convenient way to achieve that.

Tax-Savvy Investors: Those looking to save tax under Section 80C can invest in ELSS via SIPs, combining wealth creation with tax savings.

Investors with a Long-Term Horizon: SIPs work best over a long-term period, typically 5 years or more. Investors with long-term goal like buying a house, retirement, or children’s education should consider SIPs.

Who Should Invest via SSY?

Parents of Girl Children: SSY is exclusively for parents of girl children. It is the best investment option for those who want to secure their daughter’s future financially.

Conservative Investors: If you prefer a safe investment with guaranteed returns and low risk, SSY is the way to go. The government’s backing adds an extra layer of security.

Tax-Conscious Investors: Those who are keen on maximizing their tax savings should consider SSY. It offers tax benefits under Section 80C, and the interest earned and maturity amount are tax-free.

Long-Term Planners: SSY is suitable for long-term financial planning, especially for goals like higher education or the marriage of a daughter.

Investors Looking for Fixed Returns: If you prefer the certainty of fixed returns over the volatility of market-linked investments, SSY is an ideal choice.

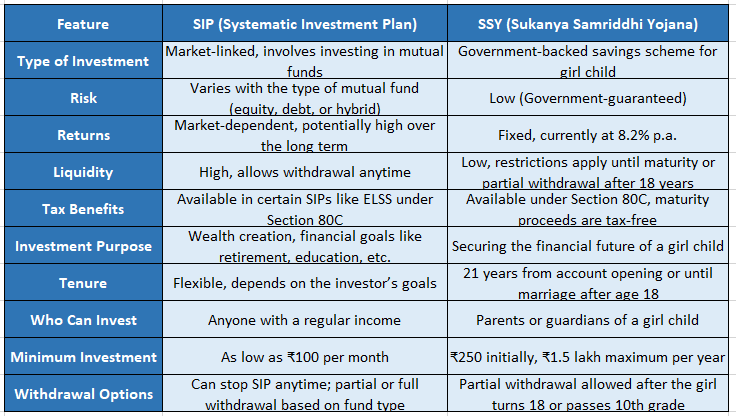

Difference between SIP and SSY

Conclusion

Both SIP and SSY serve distinct purposes and cater to different investor needs. SIPs are ideal for wealth creation with the potential for high returns, especially for those with a higher risk appetite and a long-term horizon. SSY is a low-risk, government-backed scheme perfect for parents who want to secure their daughter’s future while enjoying tax benefits.

Choosing between SIP and SSY depends on your financial goals, risk tolerance, and the specific needs of your family. For many, a balanced approach, investing in both SIPs and SSY, could be the most prudent strategy, offering both growth and security.

Frequently Asked Questions (FAQ)

Can I invest in both SIP and SSY?

Yes, you can invest in both SIP and SSY. Combining these investments can help you balance risk and return, while also securing your daughter’s future and achieving your financial goals.

What happens if I stop my SIP before the tenure ends?

Mutual fund houses usually do not levy any penalty if you miss your SIP installment for up to three months. Further, your SIP will continue as it is. However, if you default on your monthly SIP amount by not maintaining enough balance in your bank account, the bank may levy a fee or penalty

Is the interest rate of SSY fixed throughout the tenure?

No, the interest rate of SSY is not fixed. It is revised quarterly by the government based on prevailing economic conditions. However, once the rate is fixed for a particular quarter, it remains the same for that period.

Can I partially withdraw from SSY?

The SSY account is operational for 21 years from the date of opening the SSY account, or until the girl child’s marriage after 18. You can withdraw amount partially up to 50% of the balance amount for higher education expenses of the girl child after she turns 18 or passes 10th standard.

Which is better for tax savings, SIP or SSY?

SSY offers better tax benefits under the EEE (Exempt-Exempt) category. The investment amount, interest earned, and maturity amount are all tax-free. SIPs do not offer such comprehensive tax benefits, though specific mutual fund investments (ELSS) can provide tax deductions under Section 80C.

What happens if I do not contribute to SSY for a year?

Along with the default fee, you will have to deposit the minimum deposit of Rs 250 for each defaulted year. If the defaulted Sukanya Samriddhi account is not revived, then money lying in the account will be payable at maturity.