SIP vs Lumpsum investment – which one is better? this is one of the most common doubt faced by the new equity investors. Which of these two routes of investment can generate higher returns over a long period? Confused? Look no further, we have covered all aspects of this question in this blog post.

Both SIP and Lumpsum investment are good ways of investing, both have their pros and cons. Understanding the difference between both routes is important before investing your hard-earned money through these routes. Let’s begin this post by describing the difference between SIP and the lumpsum mode of investments in mutual funds.

What is SIP?

SIP or a Systematic Investment Plan is a method of investing in Mutual Funds wherein you can invest a fixed sum regularly, like weekly, monthly, or quarterly, rather than a bigger amount in a single installment. It is a long-term investment strategy that ensures disciplined investing and it’s a great way to build wealth.

What is Lumpsum Investment?

A lump sum investment in a mutual fund is a one-time investment of a large amount of money at the beginning of an investment period. Instead of regular periodic investments over time like that of SIP, the investor invests the entire amount in one go.

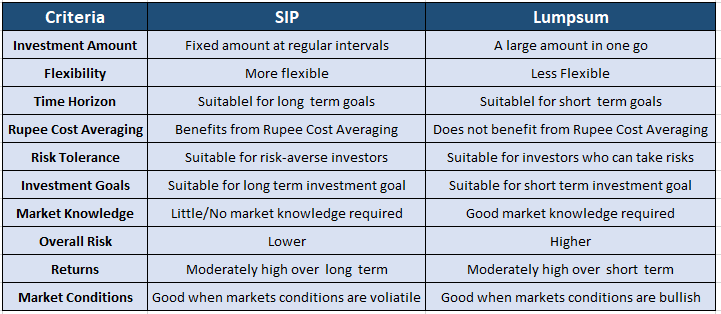

Differences between SIP and Lumpsum Investment

SIP is a way of investing a small amount of money regularly, typically monthly, whereas lumpsum investment involves investing a bigger amount in one go at the beginning of the investment period. Here are the key differences between SIP and Lumpsum investment in the below table.

Benefits of investing through SIP

- Rupee Cost of Averaging: In SIP investor purchases a higher number of units when the NAV of a fund is low and a lesser number of units when the NAV is high, and hence the cost of purchasing units averages out over the tenure of the SIP. You need not worry about how to time the market.

- Power of Compounding: Compounding happens when the returns on the investments start earning returns. With regular SIPs, your returns get reinvested, this results in a snowball effect, which increases the returns multiple times over some time.

- Flexible Investment Amount: You can start SIP, as small as Rs.100 every month and can also increase the SIP amount with the step-up feature. There is no limit to the number of SIPs you can invest in at the same time.

- Convenient Investment Method: After selecting a mutual fund, you only have to give standing instructions to the bank, and the monthly SIP will be deducted automatically.

- Disciplined Savings: SIP ensures that you develop a habit of saving money, that grows over time by staying invested in a market-linked investment that has the potential to beat inflation.

- Flexibility of Tenure: There is no limit on how long you can continue with your SIPs. Some mutual funds may have a minimum investment period of 6 months.

- Professional Management: Mutual funds are managed by professional fund managers who make informed decisions based on extensive research. Their expertise adds an extra layer of comfort for investors.

Who should consider investing through SIP?

- First-time Investor: For first time investors SIP is a very good choice as it is a simple, disciplined approach to investing and doesn’t require deep knowledge of investing.

- Young Professionals: Young professionals who have just started earning can benefit from SIP investments greatly. Young professionals may have limited disposable income, in such cases SIP becomes a great investment option.

- Long-term Investors: For long-term investment goals such as retirement planning, funding a child’s education, buying a house, etc. SIP allows for the accumulation of wealth over some time.

- Savers: For people who are disciplined savers, SIP encourages disciplined saving and investing. In SIP investments monthly SIP amount gets auto debited, it instils a sense of discipline in investing.

- Risk-averse Investors: SIP is a great choice for investors who don’t want to take more risk. As SIP involves investing in different phases of market, it decreases the impact of market volatility.

Benefits of Investing Lumpsum Amount

- No Investment Commitments: Investing lumpsum amount does not require future investment commitments from the investors and it is often preferred by self-employed and those who don’t have regular surplus income flows.

- Good Control over Investments: Investors can control the timing of their investments. One can choose to invest during market lows and allows to make the most of market corrections.

- Utilizing the Incentives: One can utilize incentives, annual bonuses, ex-gratia amounts, arrears, leave encashment, etc. in lumpsum investments. In SIP the balance amounts may continue to stay in savings bank accounts.

- Suitable in Bull Markets: Lumpsum investments allows the investors to make the most of market rallies, as the entire investible amount stays invested during the whole period.

- Power of Compounding: In the case of lumpsum investing the returns increase exponentially as the holding period increases. Time is the most significant catalyst for the compounding of returns. In SIPs, the average holding period of investments is lower than lumpsum investing in mutual funds.

- No Systematic Investment Commitment: Unlike in SIPs where there is a fixed monthly commitment, investors in lumpsum investing can make investment based on financial capacity and market outlook.

Who should consider investing in Lumpsum Amount?

- Risk Takers: If the investor is comfortable with risks in the investment style, he can potentially earn more profits by entering the market at a low point, but be prepared for some volatility.

- Incentive Earners: If you have a bonus, money in arrears, or extra cash gains through the sale of assets, then a lump sum investment is the right choice. It lets you invest it all right away and potentially grow it faster.

- Long-Term Thinkers: Investors who have long-term goals than lumpsum investments can be a better option, which allows overcoming market fluctuations.

- Those with good market knowledge: Lumpsum investments allow the investors to make the most of market rallies, as the entire investible amount stays invested during the whole period and thus allows them to make the most of the market conditions.

Things to consider before investing via SIP or Lumpsum

Before you start your investing journey via SIP or lumpsum, you should consider various factors that come into play. These factors can help you to make the right investment decisions, and thus achieve your financial goals. Here are some of the important factors that you should consider:

- Investment Amount: SIP is more suitable if you have a regular income. If you are salaried, SIP is ideal as you can invest some of your income regularly but if you have idle cash, then you can prefer to invest via lumpsum.

- Financial Goals: SIP becomes a better choice when you have long-term goals like wealth creation, retirement planning, children’s education, etc. You can use the SIP calculator to know whether the SIP will be able to fulfill your financial goals. But if you have idle cash in your bank account, then you can consider lumpsum investment in mutual funds as it will earn market-linked returns, which will be far better than the interest earned in your savings accounts or other traditional investments like fixed deposits.

- Type of Fund: Equity funds are highly volatile as they are affected by market swings. SIP protects from such market swings. Debt funds are less impacted by the market movements and give comparable returns on lump sum and SIPs, making them a reliable choice for investors looking for stability and less risk.

- Holding Period: Aim to hold your investment for at least 3 years, especially if it’s an equity fund (focused on stocks). Short-term goals might be better suited for debt or liquid funds (less risky).

- Risk Tolerance: First understand how much risk you can bear. Different mutual funds come with different levels of risk.

- Regular Monitoring: You should monitor your investments regularly and make adjustments if required so that the investments are aligned with your goals. Investing is an ongoing process.

- Charges: Investing in mutual funds comes with a cost such as exit load, transaction charges, expense ratio, etc. More charges mean lesser returns, so choose funds with competitive charges

SIP vs Lumpsum – Which one is better for Investment?

SIP comes with investing discipline and risk mitigation through rupee cost averaging. It becomes a good choice for short-term goals that require quick access to funds, providing liquidity and flexibility. Lump sum investing allows investors to invest a substantial amount in one go, which can be efficient for long-term growth. Long-term goals can benefit from higher returns through Lumpsum Investments if you have good market knowledge and can identify market opportunities.

Frequently Asked Questions?

Which is more beneficial SIP or Lumpsum?

Stock market conditions affect the performance of the mutual funds. Lumpsum investing gives higher returns during a bull market while investing via SIP during a bear phase gives superior returns.

Can I convert my Lumpsum mutual fund investment into SIP investment?

Yes, many mutual funds offer the flexibility of converting lumpsum investing into SIPs and vice versa.

Is a Lumpsum mutual fund investment risky?

Lumpsum investing can be quite riskier if the markets are volatile at the time of investing. But in the long-term markets tend to grow and thus balance the risk. Risk can be mitigated through diversification.