How to maximize SIP returns? This is a common question in the minds of investors. You can significantly enhance the potential for long-term wealth creation by carefully selecting funds, maintaining discipline, and leveraging various techniques mentioned in this article. Here we explore 20 proven strategies to help you get the most out of your SIP investments, ensuring they align with your financial goals and you get decent returns from your SIPs.

1. Start your SIP early

Time is one of the most important factors in wealth creation, the earlier you start, the more time your investments get to grow. Starting an SIP in your 20s can give significantly higher returns than starting in your 30s, even with the same monthly contribution because the magic of compounding ensures that your returns start generating their returns, leading to the exponential growth of your money over time. Ideally, you should begin your SIP journey as soon as you get a job or have a stable income, even a small amount can grow significantly if you give enough time.

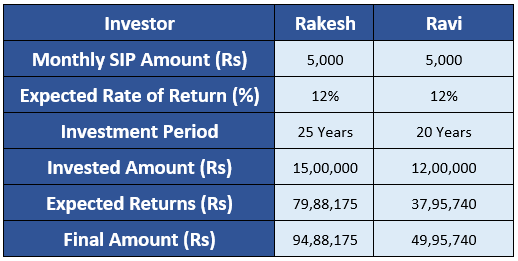

Example: Rakesh is 25 years old and starts an SIP of Rs. 5,000 at 25 when he completes his education and gets a job. Ravi is a married person who started an SIP of Rs. 5,000 at 30. Both intend to accumulate wealth and remain invested till they turn 50 years old. Now let’s estimate how much wealth they can accumulate at an average return rate of 12%.

You can check from the above table that the final amount of Rakesh is almost double that of Ravi, this is the real magic of compounding!

2. Invest for the long term

SIPs work on the principle of rupee cost averaging, which works best when you have a long investment horizon. In SIP short-term market fluctuations are smoothed out, as you continue to invest through different market cycles, over a long period the impact of these fluctuations decreases, leading to more stable and potentially higher returns.

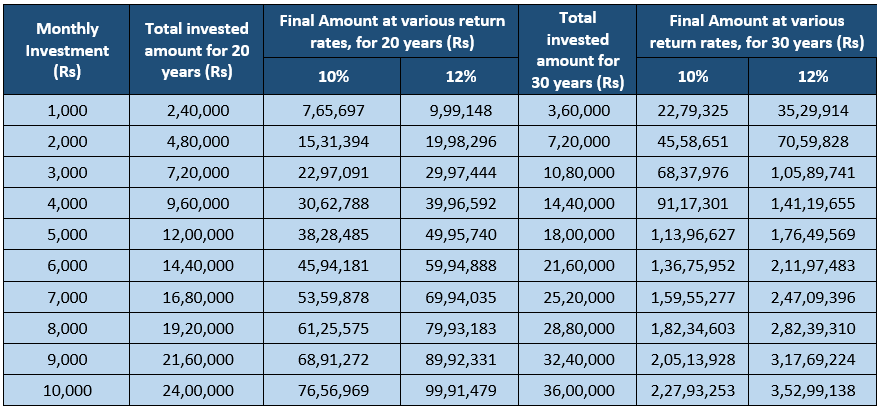

Example: Set a long investment horizon for your SIPs to allow them to grow through market cycles. From the table, you can gauge how huge wealth creation potential with SIPs is.

3. Increase your SIP amount periodically

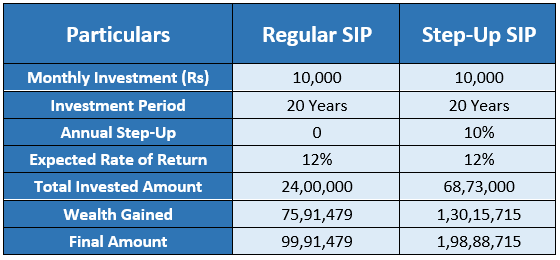

Your investments should grow as your monthly income grows. For this you should opt for a step-up SIP, where your SIP amount increases automatically by a certain percentage annually. By gradually increasing your SIP amount, you can significantly increase your corpus without putting much load on your finances.

Example: From the below table you can make out how helpful is step-up SIP to increase the final corpus.

4. Invest in direct plans of mutual funds

Direct plans of mutual funds have a lower expense ratio compared to regular plans because they do not involve third parties like agents or distributors. Over time, this lower expense ratio can lead to higher returns, especially for long-term investors. You can opt for direct plans while setting up your SIPs, either through offline mode or online mode.

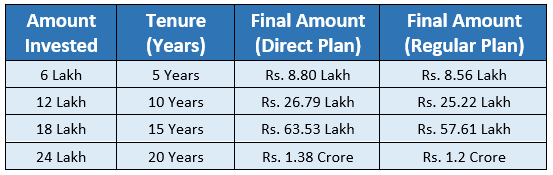

Example: Let’s take an example of an SIP of Rs.10,000 SIP started on November 1, 2023, for various time horizons. Using average returns for flexi-cap funds over the last 10 years (14.22 percent for regular and 15.34 percent for direct plans), the difference in the investment value of regular and direct plans becomes evident. You can have a look at the below table to know things better.

5. Invest in equity-oriented funds

Historically, equity-oriented funds have delivered higher returns compared to other asset classes, particularly over the long term. Equity-oriented funds invest primarily in stocks and are suitable for investors with a higher risk tolerance and a longer investment period. If your goal is long-term wealth creation, you should allocate a significant portion of your SIPs to equity funds. Based on your risk appetite you can choose from large-cap, mid-cap, or multi-cap funds.

6. Choose the right mutual funds for your SIP

The key is to select the mutual funds that align with your risk appetite, financial goals, and investment period. Not all funds are created equal, some may focus on blue-chip stocks, while others might be more aggressive and invest in mid-cap or small-cap stocks. You must thoroughly research the fund’s historical performance, its consistency, and the expertise of the fund management team. You should regularly review the portfolio composition of the chosen mutual fund and assess whether it still meets your investment criteria.

7. Chose growth funds over dividend plans

Growth-oriented mutual funds reinvest your earnings, which compounds your wealth over time. Dividend plans, on the other hand, distribute profits periodically, which might hinder the compounding effect. Growth plans are often better for long-term wealth creation compared to dividend plans, because they allow your earnings to compound over time, thereby maximizing returns.

8. Consider adding index funds to your SIP portfolio

Index funds are passively managed funds that replicate the performance of a specific index (Ex. Nifty 50). Index funds have lower expense ratios compared to actively managed funds. Over the long term, lower costs can contribute to better net returns. SIPs in index funds can be an effective way to achieve market returns with minimal management costs. So, you can consider adding index funds to your portfolio for low-cost, broad market exposure.

9. Don’t stop SIPs in a market downturn

Market corrections often create fear among many investors, leading them to stop their SIPs. However, market downturns are the times when SIPs actually work to your advantage by purchasing more units at lower prices. When the market eventually recovers, these additional units contribute significantly to your overall returns. You must continue your SIPs during downturns and see them as opportunities to accumulate more at lower costs. You must try to keep some funds aside to take advantage of market corrections by making additional investments in your chosen funds.

10. Focus on consistency, not timing

One of the major advantages of SIPs is that they eliminate the need to time the market. Consistent investing makes sure that you are buying at different price points, which averages out the cost over time. This disciplined approach often leads to better outcomes compared to attempting to time the market. Regardless of market conditions you must stick to your SIP schedule and avoid trying to predict short-term movements of the market.

11. Be patient and disciplined

Wealth creation through SIPs is not a sprint but a marathon. Market volatility, economic downturns, and temporary underperformance are all part of the wealth-creation journey. Staying patient and disciplined through these phases is very important for maximizing your SIP returns. You must develop a long-term mindset, and avoid the urge to withdraw your investments prematurely because the real benefits of SIPs are often realized only after several years of consistent investing.

12. Diversify your SIPs across different asset classes

Diversification is an important principle in risk management. By investing in different asset classes such as equity, debt, and gold, you reduce the risk of your entire portfolio underperforming at the same time. Equity can give higher returns, but it comes with higher volatility. Debt funds offer stability but have comparatively lower returns, while gold acts as a hedge against inflation. You must ensure that your SIP portfolio is balanced across multiple asset classes to optimize risk-adjusted returns.

13. Rebalance your portfolio regularly

The performance of different asset classes may vary over time, which can skew your original asset allocation. Rebalancing the portfolio involves adjusting your portfolio back to its intended allocation, which helps in maintaining your risk profile and maximizing returns. Rebalancing may involve shifting funds from overperforming to underperforming assets. Review your portfolio at least once a year and if necessary, rebalance it to maintain your desired asset allocation.

14. Consider tax implications

Understanding the tax implications of your SIP investments can help you make more informed decisions. Equity mutual funds and Debt mutual funds have different tax treatments. LTCG income tax on mutual funds (equity-oriented schemes) is charged at the rate of 12.5% on capital gains over ₹1.5 lakh (as per the latest update in Budget 2024) as per section 112A of the Income Tax Act, 1961. For Debt funds investments made after April 1, 2023, gains are added to your income and taxed at your slab rate, regardless of how long you invest.

15. Align your SIPs with Financial Goals

When you align your SIPs with specific goals it helps in choosing the appropriate investment horizon and fund type. You may have different financial goals—retirement, children’s education, buying a home, etc. Equity funds are good for long-term goals, while debt funds might be more suitable for short-term needs. You must clearly define your financial goals and allocate SIPs accordingly. Better create separate SIPs for each of these goals so that you can track progress effectively.