How much salary should be invested in SIPs? This is a common question in the minds of salaried investors and we have covered all the aspects of this question in this blog post. SIPs have become a popular investment tool for those looking to grow their wealth gradually over time. They offer a disciplined approach to investing, allowing individuals to invest a fixed amount of money regularly, typically every month, in mutual funds. This method enables investors to benefit from the power of compounding and rupee cost averaging, which can mitigate the impact of market volatility. This article digs deep into various factors to help you determine the right amount of your salary to allocate towards SIPs.

1. Understand your financial goals

Before deciding how much to invest, you must have a clear understanding of your financial goals. These goals could be short-term (such as a vacation, buying a car, or creating an emergency fund), medium-term (such as children’s education, home down payment, or buying property), or long-term (such as retirement planning or wealth creation).

Your financial goals will determine how much you need to invest and for how long. Long-term goals might require more significant investments, and SIPs can be a perfect vehicle for such goals due to the benefit of compounding over time.

2. Know how much risk can you bear

Risk tolerance differs from person to person, affected by factors like age, financial stability, investment knowledge, and market experience. A younger individual with fewer financial responsibilities might have a higher risk tolerance and therefore could allocate a larger portion of their salary to equity-focused SIPs, which typically offer higher returns but come with increased volatility.

If someone is nearing retirement may prefer more conservative investments, focusing on capital preservation rather than high returns. Your risk tolerance will directly impact the percentage of your salary you should allocate to SIPs.

3.Evaluate your monthly budget

You should thoroughly know your monthly income, expenses, and savings before committing to a SIP. Start by listing your fixed and variable expenses—rent or mortgage payments, utility bills, groceries, transportation, insurance premiums, discretionary spending, etc. Once you have a clear picture of all of such expenses, calculate your disposable income, that is the amount left after covering all your mandatory expenses. A portion of this disposable income can be allocated to SIPs. Financial advisors often recommend the 50/30/20 rule as a guideline, it says:

50% of income for needs: Essentials such as housing, groceries, utilities, etc.

30% of income for wants: Non-essential expenses like dining out, entertainment, hobbies, etc.

20% of income for savings and investments: This includes SIPs, emergency funds, retirement accounts, and other investments.

Using this rule, you could consider allocating at least 20% of your income toward savings and investments, including SIPs. However, this 20% can be adjusted based on individual circumstances and goals. You might have other investments, so accordingly you can adjust the percentage of the SIP amount to be invested every month.

4. Start small and gradually scale up

If you are new to investing or have limited disposable income, start with a small SIP amount. The beauty of SIPs lies in the flexibility they give, to begin with a modest sum and gradually increase it as your financial situation improves or your confidence grows. Let’s consider an example where you are left with ₹10,000 after covering your essential expenses, you can start with a ₹2,000 monthly SIP. As your income grows, or you get more comfortable with investing, you can increase this amount by 10-20% annually.

5. Emergency Funds

Always ensure that you have an adequate emergency fund. An emergency fund should ideally cover 6 months of your living expenses, acting as a financial cushion in case of unexpected events like job loss, medical emergencies, or sudden major expenses. Emergency funds will give you the confidence to invest a larger portion of your salary in SIPs without worrying about liquidity in times of need. If you withdraw money from SIP funds during emergencies you will disrupt your long-term financial goals.

6. Consider your debt obligations

If you have existing debt, such as a home loan, car loan, or personal loan, don’t forget to factor these expenses into your budget. The goal is to balance your investments and debt repayments. Though it’s very important to invest for the future, high-interest debt, like credit card debt, should be paid off first. If the interest on your debt is higher than the potential returns from your SIPs, consider focusing on debt repayment before committing a large portion of your salary to SIPs.

7. Time horizon and power of compounding

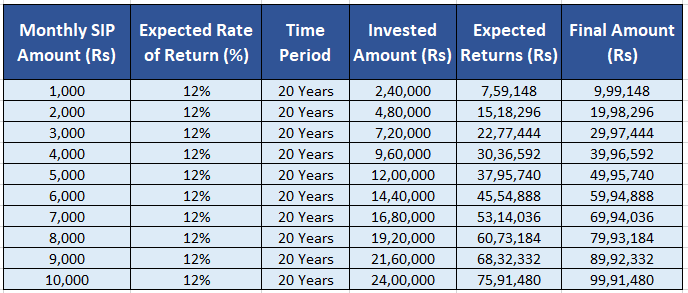

The best part of SIPs is the benefit of the power of compounding, where your returns earn additional returns over time. The earlier you start investing, the more you benefit from compounding, even if the initial investment amount is small. You can have a look at the illustration above to get a feel of the power of compounding.

8. Align your SIP investments with your goals

You must always align your SIP investments with specific goals. For example, if you are investing for retirement, equity mutual funds might be more suitable as they offer higher returns over the long term. Short-term goals like vacation debt or balanced funds might be more suitable as they are less volatile.

9. Review and adjust your SIPs periodically

Regularly review your SIP investments to ensure they are on track to meet your goals. Changes in income, lifestyle, or financial goals might necessitate adjustments in your SIP amount. Similarly, market conditions or changes in fund performance might require rebalancing your portfolio. If your salary increases or if you receive bonuses, consider increasing your SIP contributions to accelerate wealth accumulation.

Conclusion: How much salary should you invest in SIPs?

A wise approach to this question is to aim for at least 20% of your income towards savings and investments, with a significant portion allocated to SIPs. However, this can differ based on your circumstances, such as your financial goals, risk tolerance, current obligations, and lifestyle.

Starting with a smaller amount and gradually increasing it over time as your income and financial stability grow is a good strategy. The most important thing is to start early and stay consistent, allowing your investments to grow and compound over time ensuring a balance between current needs and future aspirations.