SIP vs STP : Which one is better? is a common question in the minds of investors. SIP is a systematic way of investing in various Mutual Funds, whereas STP is a systematic transfer of funds from one Mutual Fund plan to another of the same fund house. Systematic Investment Plans (SIPs) and Systematic Transfer Plans (STPs) are similar in that they help make regular investments at a fixed frequency but are different in how they function. Let’s understand both individually and the difference between both.

SIP: A SIP is a method of investing in Mutual Funds where an investor puts in a fixed amount at regular intervals— weekly, monthly, or quarterly — into any Mutual Fund Scheme. This approach encourages a systematic and disciplined investment strategy. In SIP you put aside some of your monthly income towards your investment goals.

STP: An STP involves transferring a predetermined fixed amount from one Mutual Fund Scheme to another within the same Fund House. This allows the investor to move funds between schemes according to a set schedule gradually. Typically, investors use STP to transfer progressively money from a debt to an equity fund and this is especially useful when you have a large sum of money to invest but are not sure of entering the equity markets in one go due to high volatility or overvaluation concerns.

How does SIP and STP work?

Let’s understand the working of SIP and STP with an example

SIP Example: A person who wants to opt for a SIP in a mutual fund will have to first choose the right mutual fund, select the investment frequency (e.g. weekly, monthly, quarterly), choose the amount he wishes to invest (e.g. Rs. 5,000, Rs. 10,000), set up the Scheme and automatic debits from their bank account to the chosen mutual fund. In this way Rs. 10,000 will be invested in the selected Mutual Fund Scheme through the Systematic Investment Plan.

STP Example: An investor with a Rs. 20 lakh lump sum might avoid investing it all in one go in equity funds due to market fluctuations. Instead, the investor invests the entire amount in short-term debt funds, which are less volatile. Subsequently, the investor can establish an STP to transfer money from the debt funds into a selected equity fund of the same fund house at regular intervals. The investor can arrange an STP involving one or more schemes within the same fund house. It’s also important to check for any exit load associated with the debt fund where the lump sum is initially invested

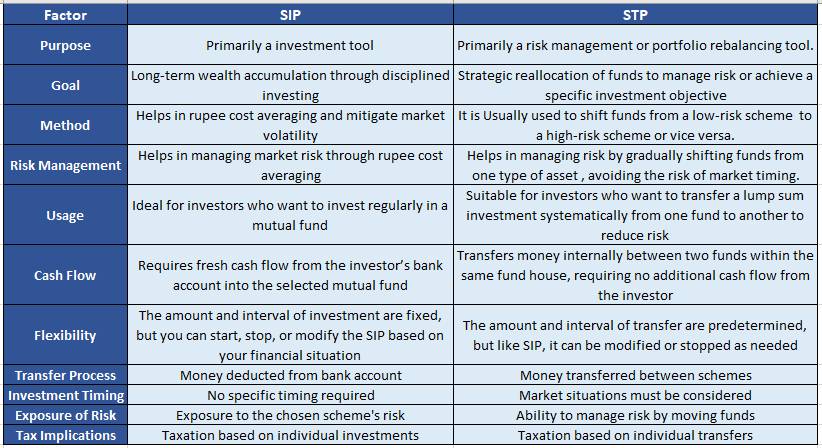

Differences between SIP and STP

Both SIP and STP involve periodic investments, but there are some key differences between them, let’s look into these differences:

SIP vs STP – Which one is better for you?

Both SIP and STP are effective investment tools with unique benefits. SIP involves regular contributions to a single scheme, that encourages disciplined investing, while STP facilitates the transfer of funds between schemes within the same mutual fund house. STP enhances risk management, allows for diversification, and helps lock in profits benefiting from professional fund management.

The choice between SIP and STP should align with individual investment goals, risk tolerance, and financial objectives. Both strategies offer systematic approaches to investing, helping investors navigate financial markets and achieve long-term financial goals.

When SIP might be a better option:

- When you have a regular income and want to invest some portion of it regularly

- When you are investing for the long term (5+ years) to meet various goals like retirement, housing, child’s education.

- When you want to cultivate a disciplined investing habit without worrying about market volatility

When STP might be the better option:

- When you have a large sum of money to invest but worry about market volatility.

- When you want to shift gradually from lower-risk debt to higher-risk equity investments.

- When you want to allocate funds across asset classes based on market situations tactically.

There is no hard and fast rule for SIP or STP investments, you can also combine SIP and STP as part of your overall financial plan. For example, you can invest your surplus money in a debt fund through SIP and periodically transfer a portion of it to an equity fund through STP.