Sip Calculator – Systematic Investment Plan Calculator

What is a SIP calculator, how does it work?

A SIP calculator is a simple tool that helps investors estimate the potential returns on their mutual fund investments made through a Systematic Investment Plan (SIP). By entering details like the monthly investment amount, investment duration, and expected annual return, the calculator provides a rough estimate of the maturity amount. The actual returns may vary based on factors like market performance, exit load, and expense ratios, which the calculator does not account for. SIP calculator is a valuable tool for investors to plan and project their financial goals with more clarity.

A SIP calculator uses the following formula to calculate the maturity amount:

M = P × ({[1 + i]^n – 1} / i) × (1 + i)

Where:

- M is the maturity amount.

- P is the amount invested at regular intervals.

- n is the number of payments made.

- i is the periodic interest rate.

For example, if you want to invest ₹7,500 monthly in a mutual fund for 10 years at an annual return of 12%, the calculations would look like as below:

M = 7,500 [ (1+0.01) ^120-1] * (1+0.01)/0.01

M = ₹17,61,988.75

Hence, at the end of 10 years, your maturity amount would be approximately ₹17,61,988.75.

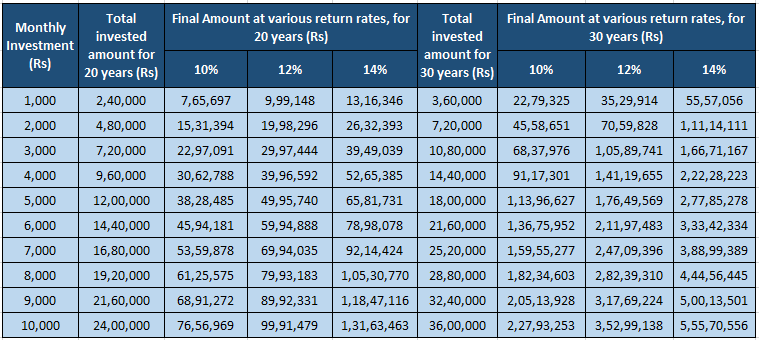

SIP Calculations Table

Disclaimer: This is only an illustration, the calculator doesn’t take into consideration the charges associated with mutual fund investments like expense ratio, exit load, etc.

What is SIP?

SIP or a Systematic Investment Plan is a method of investing in Mutual Funds that allows people to invest a fixed sum regularly, like weekly, monthly, or quarterly, rather than a bigger amount in a single instalment. Investors can start as low as Rs. 100 per month and is hassle-free with automated monthly deductions from your bank account. SIP is a long-term investment strategy that ensures disciplined investing. The best mantra is to start early and invest regularly for the best outcomes in long-term investments.

How does SIP work?

An SIP (Systematic Investment Plan) works like a recurring investment, where a fixed amount is automatically debited from your bank account and invested in the mutual fund you have chosen. After the amount is deposited, you receive a certain number of units of that mutual fund scheme based on the Net Asset Value (NAV) on the day of the investment.

With every SIP instalment, additional units are added to your investment. Since the NAV fluctuates, the same SIP amount allows you to purchase fewer units when the market is high and more units when the market is low.

There are two underlying processes to understand the work of SIP.

1. The power of compounding works in favour of SIP

Every time you invest money in the mutual fund through the SIP route, you get some units of the mutual fund at the prevailing NAV (Net Asset Value). The NAV is the price per unit of the mutual fund. Once you start investing regularly, you accumulate more units and your investment grows. You can redeem the units whenever you want and can track the performance of your SIP online or offline easily.

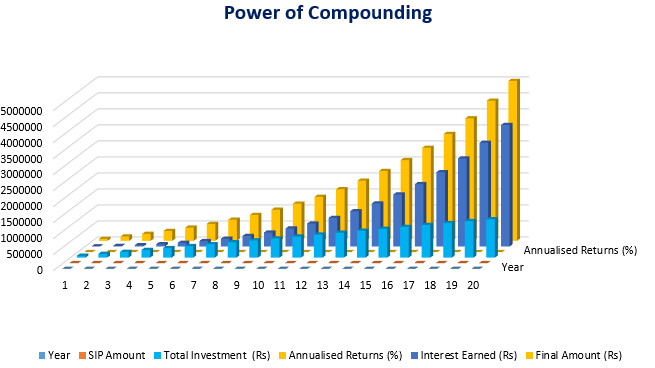

The power of compounding is the most advantageous feature of SIP. Simple interest calculations are based on the principal amount, but in compounding the profit earnings gets reinvested, resulting in exponential growth over time. Hence, it is advisable to remain invested for a longer period through SIPs.

Investors can leverage compounding to create substantial wealth by starting early and remaining committed to it for a longer period. If you have an SIP of Rs.5000 and you intend to invest for 20 years with an expected annualized return rate of 12% the graph would look as below, that is the magic of compounding in SIP !

2. Rupee cost averaging works in favour of SIP

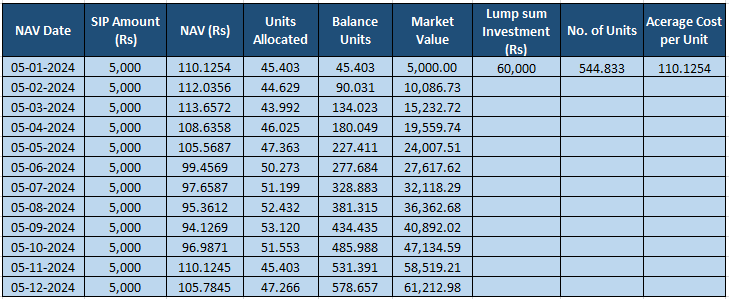

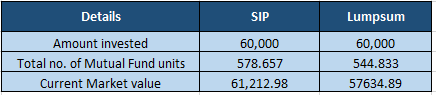

Rupee cost averaging is another great feature of SIP, you purchase more units when the market is low and fewer units when the market is high. The strategy of rupee cost averaging reduces the impact of market volatility on overall investment.

Let’s take an example, Ajay invests a fixed amount of Rs. 5,000 every month with an SIP in a mutual fund. He gets units of mutual funds at various NAVs. In one year, he invests Rs. 60,00. His friend Vijay invest Rs,60,000 in one go. Now let’s compare the returns they achieve at the end of the 12 months.

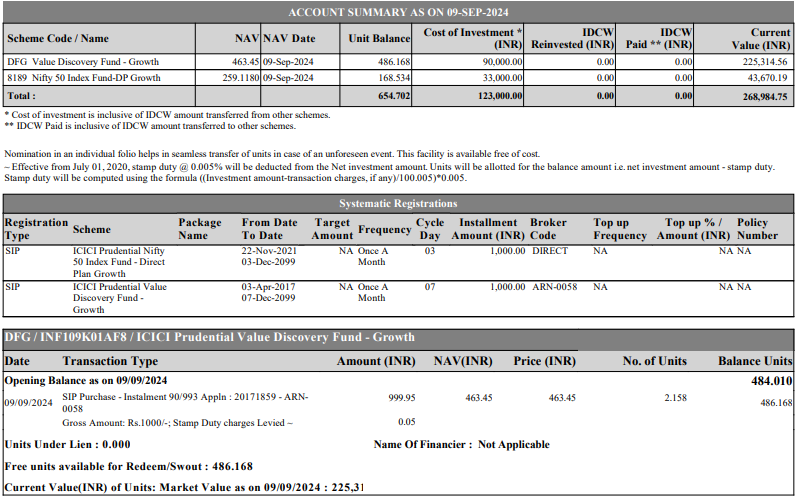

The typical SIP monthly statement will look like below

The above example is only for illustration purposes with the assumed price of units shown only for understanding purposes. The same should not be construed as returns that the investors may receive. It does not promise, assure, guarantee, or indicate any returns.

Advantages and Disadvantages of SIPs

As every investment has its advantages and disadvantages, so is the case with SIP. The below table takes into account all the advantages and disadvantages of SIP investment

Advantages of SIP

- Rupee Cost of Averaging: In SIP you purchase a higher number of units when the NAV of a fund is low and a lesser number of units when the NAV is high, it ensures that the cost of purchasing mutual fund units averages out over the tenure of the SIP. You do not have to worry about how to time the market if you are investing through SIP.

- Power of Compounding: Compounding happens when the returns on the investments start earning returns. With regular SIPs, your returns also get reinvested, and with time, this results in a snowball effect, which increases the returns multiple times.

- Flexible Investment Amount: You can start SIP, as small as Rs.500 every month. This will not hurt your wallet. You can also increase the SIP amount with the step-up feature. There is no limit to the number of SIPs you can invest in at the same time.

- Convenient Investment Method: Once you choose a good mutual fund, you can just give standing instructions to the bank, and the monthly SIP will be deducted automatically so that you never miss out on an investment opportunity.

- Disciplined Savings: SIP ensures that you develop a habit of saving money, that grows over time by staying invested in a market-linked investment that has the potential to beat inflation. The potential of mutual funds to generate inflation-beating returns is an advantage that is not available with many other investments.

- Flexibility of Tenure: Some mutual funds might need you to make a minimum investment of 6 SIP instalments. There is no limit on how long you can continue with your SIPs. This flexibility to keep investing for as long or as short a time as possible is not available with lump sum investment in mutual funds.

- No market timing concerns: AS you keep investing regularly irrespective of market fluctuations, there is a systematic investment approach, you can mitigate market timing risks and focus on long-term growth. This reduces stress and anxiety associated with market volatility.

- Acts as an Emergency Fund: SIP money is readily accessible, and offers swift and hassle-free access to your money. Several mutual funds provide instant withdrawal facilities, ensuring the funds land in your bank account when needed.

- Professional Management: Mutual funds are managed by professional fund managers who make informed decisions based on extensive research. Their expertise can help navigate the complexities of the financial markets, adding an extra layer of comfort for investors.

- Transparency: SIPs function with high transparency, you can track your fund’s performance and make informed decisions regularly. Mutual funds in India SEBI. This regulation ensures these investment products’ transparency, fairness, and integrity, providing an extra layer of safety for investors.

- Inflation Beating Returns: Over the long term, market-linked mutual funds have the potential to provide returns that outpace inflation, helping to preserve the purchasing power of your emergency fund. You can check out some of the best-performing SIP plans.

- Investment Options: You can invest in different types of mutual funds ranging from equity funds, debt funds, balanced funds, sectoral funds to index funds, and many more. Based on your investment goal and risk you can choose the SIP that is most suitable to your investment goal.

- Portfolio Diversification: You can consider SIPs as a way to diversify your portfolio. Mutual funds invest in a wide range of securities including debt and money market instruments. This diversification helps spread the risk and can lead to more stable returns, making them suitable for emergency funds.

Disadvantages of SIP

- Doesn’t work in a continuously rising market: When the market goes up and keeps growing over time, the units bought each time are at a higher value than the previous one, which can ultimately bring the average value up, compared to the lump sum investment at the beginning.

- Tax saver Mutual Funds schemes lock your money for three years: In tax-saver mutual funds, all of your investment is locked individually for three years from the date of investment. If your first instalment was in March 2015, it’ll be locked until March 2018, and then the instalments paid in April 2016 is locked until April 2018 and so forth.

- Not for Short-Term Investors: The ROI of SIPs is best when invested for a long period. You won’t be happy after looking at the results if you invest for a short period in SIP schemes. To obtain a great ROI from SIPs, you need to have a lot of patience and need to invest for at least 15-20 years.

- SIPs are for People with Fixed Cash Flows: A person who receives a fixed amount at the end of each month can easily invest through SIP plans. But for a person with unpredictable cash flows, SIP programs can be difficult to manage.

- SIPs are not always better than lump sum: Sometimes lump sum investment can prove to be a better choice than a SIP. Seasoned investors who follow the market and have surplus cash can make lump sum investments when the market is low and expected to grow further. These returns are more than what one earns in a SIP. Additionally, if you strongly believe that the market will go up shortly, investing a lump sum would be better than SIP since SIP will average your cost.

Types of Mutual Fund SIPs in India

Systematic Investment Plan (SIP) is a disciplined way of investing with just a one-time mandate. You can make investments every month or quarter but keeping your SIPs intact for a longer period is the key, because that is how investors generate significant returns. However, choosing the right kind of SIP is the key. Following are the different types of SIP investments available in India.

- Regular SIP: A Regular SIP is the most basic type, where you invest a fixed amount at regular intervals— monthly, quarterly, or half-yearly. While daily and weekly SIPs are also available, they are less recommended. When setting up a Regular SIP, you need to specify the duration, instalment amount, and frequency.

- Step-up SIP: A Step-up SIP, also known as a Top-up SIP, allows you to periodically increase your investment amount. This adds flexibility to your contributions and enables you to invest larger sums over time. As your income grows, you can raise your SIP amount, helping you save more and build a larger corpus due to the power of compounding. Regular top-ups accelerate the creation of your investment corpus and help mitigate the effects of inflation on your returns. A Top-up SIP calculator can help estimate the maturity amount.

- Flexi-SIP: A Flexi-SIP lets you adjust your SIP amount based on financial or market conditions. There’s a formula in place that allows you to invest more when markets are down and reduce contributions when markets are high. You simply need to notify the fund house of these changes. In case of a cash crunch, you can pause your SIP payments without defaulting. On the other hand, when you have extra cash, you can increase your SIP amount for a specific period, and the fund house will adjust accordingly.

- Perpetual SIP: If you don’t specify a tenure in your SIP application, it automatically becomes a Perpetual SIP, meaning it continues until you instruct the fund house to stop. If you prefer not to limit your contributions to a fixed term, you can opt for this option. A Perpetual SIP allows for long-term investment and market observation, and you can redeem your funds at any time in the future.

- Trigger SIP: Trigger SIPs are suited for investors who understand market dynamics and are confident in predicting market movements. This type involves speculating on market conditions and requires experience to set effective triggers. Investors can set conditions like a market event, index level, NAV change, or capital appreciation/depreciation as triggers to start, stop, or switch their SIPs. However, it’s important to know when to take buy or sell positions, making this option best for seasoned investors.

- SIP with Insurance: Some mutual funds offer term life insurance when you opt for long-term investments. This insurance is an add-on and does not affect the fund’s performance. Typically, the initial insurance coverage is ten times the first SIP amount and increases over time. However, this feature is usually only available for equity mutual funds.

- Multi SIP: A Multi-SIP allows you to invest in multiple schemes within a fund house through a single transaction, helping you diversify your portfolio. It also reduces paperwork by allowing you to start several SIPs with just one form and payment instruction.

Which type of SIP is the best to invest?

The best SIP depends on your goals, income, and knowledge.

- A regular SIP is best for all types of investors with a regular source of income and who plan to save up for a secured future.

- A step-up SIP helps reach the financial goal faster compared to regular SIP and helps in accumulating a higher amount of corpus as the investment amount keeps increasing every year.

- A perpetual SIP is a regular SIP that continues till eternity. It can be both regular as well as step-up SIP.

- Flexible SIP is suitable for people whose income is variable, for example, professionals and freelancers.

- Trigger SIP is only suitable for investors who have good knowledge about market dynamics.

- SIP with insurance is a new type of plan, and investors don’t have many options available in the market. Investors should opt only for this type of plan if the fund performance is good and the life cover provided by the fund house is free.

- Multi SIP only works when all the mutual funds of a fund house are giving good returns in their category.

Through SIP, you have to invest the same amount regularly or increase the amount of SIP due to market conditions or having additional income at hand.

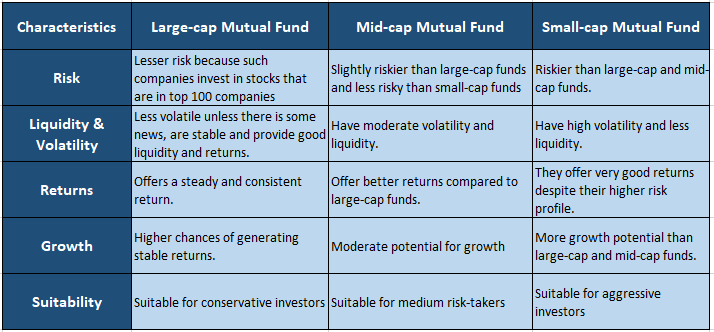

What type of mutual fund is best for SIP Investment – Large Cap, Mid Cap, or Small Cap?

Before we decide on the right type of mutual fund for SIP investment it’s important to know the difference between large-cap, mid-cap, and small-cap companies. Firstly, you must know the meaning of Market Capitalization.

Market capitalization: Market Capitalization: It is the market value of all the outstanding shares owned by a company’s shareholders. The stock market determines the worth of the company. It is calculated by multiplying the entire number of a company’s outstanding shares by the current market price of one share, which is commonly referred to as ‘market cap’.

There are 3 types of Market Capitalization:

- Large-cap

- Mid-cap

- Small-cap

SEBI established certain regulations in 2017 to categorize companies according to their market capitalization.

- Large-cap Companies: The top 100 companies listed on the stock market by market capitalization are referred to as large-cap companies. Mutual funds that invest in these companies are known as ‘Large-cap funds.’ Large-cap companies generally have strong track records, with a market value typically exceeding Rs. 20,000 crores. Due to their size and stability, these companies are often called ‘blue-chip stocks.’

- Mid-cap Companies: Companies ranked between 101 and 250 based on market capitalization are classified as mid-cap companies, with market values ranging from Rs. 5,000 crores to Rs. 20,000 crores. Mutual funds that invest in mid-cap companies are called ‘Mid-cap funds.’ While these companies also tend to have solid track records, mid-cap funds carry more risk than large-cap funds. Due to their relatively smaller market presence, mid-cap companies may or may not be included in broader market indexes.

- Small-cap Companies: Small-cap companies are those ranked 251st and beyond in terms of market capitalization, with values under Rs. 5,000 crores. Mutual funds investing in these companies are known as ‘Small-cap funds.’ These companies often lack an extensive track record and can include start-ups or businesses in the early stages of development. Due to their minimal market presence, small-cap companies are usually not part of major market indices.

While deciding the type of mutual fund for your SIP, you must take into consideration your risk tolerance and financial goals.

- Large-cap funds prioritize stability and hence are suitable for conservative investors.

- Mid-cap and small-cap funds focus on growing companies and offer the potential for higher returns but come with a greater risk, hence such funds are suitable to investors with aggressive risk profiles.

By knowing the risk profile of mutual funds, you must make informed investment decisions to achieve your financial objectives.

Can SIP go in Loss?

Whether a SIP can go in a loss depends on the performance of the mutual fund in which the SIP is invested. If the NAV of the mutual fund decreases due to market conditions the SIP investment will also show a loss. Investing in the stock market or mutual fund always carries a certain level of risk, and the value of investments can fluctuate, resulting in losses.

SIPs are a disciplined and long-term investment strategy and allow investors to benefit from rupee cost averaging, where they buy more units when prices are low and fewer units when prices are high. If SIP has losses let’s figure it out. The following points must be kept in mind before you start your investment journey through SIP.

- SIP carries market risk: Mutual Funds are subjected to market risk. If the market goes down continuously, your SIP corpus may decline and you might end up with a value less than what you invested. Prices of financial instruments can fluctuate due to various factors such as economic conditions, geopolitical events, and company-specific developments. Sometimes investors can see a volatile market and risk of losing money. Investments in stocks always come with a risk.

- SIP carries market liquidity risk: Liquidity in mutual funds refers to the ease with which mutual fund units can be bought or sold in the market without affecting their price. Sometimes there could be lower liquidity, meaning there may be fewer buyers or sellers, which can lead to challenges in executing trades at desired prices. This can result in higher transaction costs and potential difficulty in accessing invested funds quickly.

- There can be fluctuations in the SIP corpus: When you do SIP in bonds/debt mutual funds, there is always an interest rate risk. When interest rates go up or down, it can affect how much your investments are worth. Bond prices tend to move inversely to interest rates. When interest rates rise, the prices of existing bonds may fall, and vice versa. So, the value of bonds and your SIP corpus can change based on what’s happening with interest rates.

- Patient or Disciplined redemptions are important: You should always take your time and think carefully before making big decisions about your investments, especially when the market is going through a tough time. You must have a well-thought-out and disciplined investment strategy. Quickly selling mutual fund units when the market is not doing well, might not be the best choice. It can lead to results that are not as good as they could be.

- Rupee Cost Averaging: Rupee cost averaging is a strategy employed in systematic investment plans (SIPs), where investors contribute a fixed amount at regular intervals, regardless of the market conditions, this approach allows investors to buy more units when prices are lower and fewer units when prices are higher. The major goal of SIP investing is to generate profit from the falling market. Over time, the strategy of rupee-cost averaging reduces the impact of market volatility and potentially enhances returns.

Frequently Asked Questions (FAQs)

Which is the best date to start an SIP?

There is no particular date of the month to start a SIP. Your convenience should be the only determining criterion to start a new SIP. If you receive your monthly salary at the end of the month, then you can plan your SIP in the first week of the following month. This will maintain a financial discipline as your amount will be deducted at the start of the month itself keeping a little room for missing any instalment.

How much to invest in SIP?

There is no minimum or maximum limit for SIP investment, the minimum amount you can start is Rs. 500 every month. However, the amount you invest through SIP must be aligned with your financial goals. As SIP is a long-term strategy you should also consider how much can you afford without feeling the burden of it.

What happens when SIP is missed?

There are no severe consequences of missing an SIP and the AMC or broker does not charge you for the missed payment. However, your bank will charge you for not maintaining the required balance and missing the auto-debit payment through ECS.

If there are insufficient funds at that point, the bank considers it like a cheque dishonored and charges you for it. Banks have their own set of charges for ECS rejection, which range from ₹150 to ₹750. In such cases, it is advisable to pause your SIP and resume the same after you have deposited the sufficient amount in your bank account. If you miss 3 consecutive SIP instalments then it will lead to automatic cancellation of your SIP by the AMC.

How to stop SIP?

- Get an SIP cancellation form from the respective AMC or through an online Mutual Fund Registrar and Transfer websites such as CAMS and KFin Technologies Limited.

- Get the SIP cancellation form from the respective AMC or through online Mutual Fund Registrar and Transfer websites such as CAMS and KFin Technologies Limited and submit it to the AMC office/branch. It takes around 14-21 days to complete the cancellation procedure, but some fund houses may complete the same in 1-2 days.

- For online cancellation visit the website of the AMC of the respective mutual fund and follow the instructions to cancel your SIP.

How to increase the SIP amount?

You can increase the SIP amount in two ways. One way is to increase the SIP amount is by manually registering for an additional SIP with the desired amount. The second way is to register for a Step-Up SIP and increase the SIP amount by the specified percentage/ amount at periodical intervals as per your choice.

Sandeep Naik

I am an MBA(Finance) & Chartered Wealth Manager (CWM), with a more than a decade of experience in the finance field.

The content on the website sipcalculatorpro.com is only for information and educational purpose. Sipcalculatorpro.com is just a web based tool for getting a rough estimate about the future value on your SIP investments. Investment in mutual funds is subject to market risk, do your own analysis or hire a financial advisor/planner before arriving at any decision. We are not SEBI Registered. Sipcalculatorpro.com do not take any responsibility for the accuracy of the data and will not be held responsible or liable for any action taken, losses incurred or emotional stress caused as a result of investment related decision.